Understanding Crypto Wallets: Your Gateway to Secure Digital Assets

In the world of digital currencies and decentralized finance, one of the most important tools you’ll encounter is a crypto wallet. It serves as your secure vault, allowing you to store, send, and receive cryptocurrencies. Whether you’re an experienced investor or just starting to explore the world of cryptocurrencies, understanding the role and functionality of a trust wallet is essential.

What is a Crypto Wallet?

A crypto wallet is a digital tool that enables users to interact with blockchain networks. Unlike traditional wallets that store physical cash and cards, a crypto wallet stores private keys—secret codes that give you access to your cryptocurrencies on the blockchain.

At its core, a crypto wallet helps you manage your digital assets by storing these private keys securely. When you want to send or receive cryptocurrency, the wallet is the interface that facilitates these transactions. It’s crucial to understand that your crypto wallet doesn’t actually store coins themselves—rather, it stores the keys that give you access to your cryptocurrency on the blockchain.

Types of Crypto Wallets

There are several types of crypto wallets, each offering different features in terms of security, usability, and access:

1. Hot Wallets (Online Wallets)

Hot wallets are connected to the internet and are often used for everyday transactions. They are generally more convenient and user-friendly, but they can be more vulnerable to hacking or malware attacks since they are always online. Examples of hot wallets include:

- Web Wallets: These are accessible via a web browser, often provided by exchanges such as Binance or Coinbase.

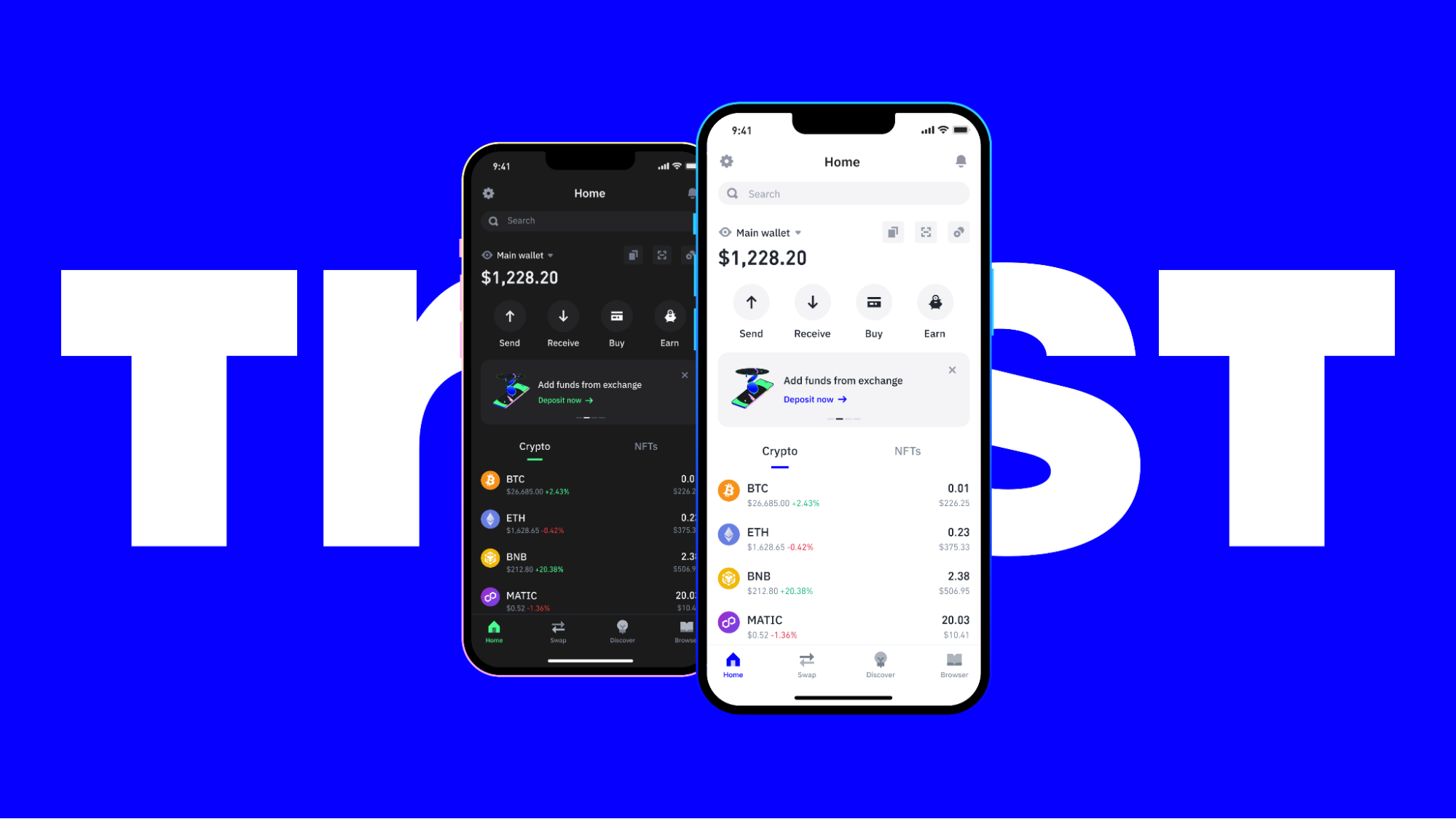

- Mobile Wallets: Apps installed on your phone that allow you to manage cryptocurrencies on the go, such as Trust Wallet or MetaMask.

- Desktop Wallets: Software downloaded to your computer, such as Exodus or Electrum.

2. Cold Wallets (Offline Wallets)

Cold wallets are stored offline, providing an extra layer of security against online threats. These wallets are best suited for long-term storage or for holding significant amounts of cryptocurrency. There are two main types of cold wallets:

- Hardware Wallets: Physical devices, such as the Ledger Nano S or Trezor, that store private keys offline and only connect to the internet when necessary for transactions.

- Paper Wallets: A physical printout or a written note containing private keys and public addresses, which is not connected to the internet.

3. Custodial Wallets

Custodial wallets are managed by a third-party service provider, such as a cryptocurrency exchange or wallet service. The service holds your private keys for you, and you access your assets via their platform. While these wallets are easy to use, the trade-off is that you trust the service with your keys and funds. Examples include wallets provided by exchanges like Coinbase or Kraken.

4. Non-Custodial Wallets

In contrast to custodial wallets, non-custodial wallets give you full control over your private keys. This type of wallet is typically more secure, as it eliminates the risk of a third-party service provider being compromised. Examples of non-custodial wallets include MetaMask and Mycelium.

How Does a Crypto Wallet Work?

A crypto wallet uses a combination of public and private keys to manage transactions:

- Public Key: Think of this like your account number. It’s used by others to send cryptocurrency to you.

- Private Key: This is like the password or PIN to access and manage your cryptocurrency. It should always be kept secret, as anyone with access to the private key can control your funds.

When you want to send cryptocurrency, you sign the transaction with your private key, proving that you own the funds. The transaction is then broadcast to the blockchain network, where it is verified by miners or validators.

Why Do You Need a Crypto Wallet?

Crypto wallets provide several essential functions for anyone involved in the cryptocurrency ecosystem:

- Security: Storing private keys securely is the first line of defense against theft or hacking. Using a wallet with strong encryption and security features ensures your assets are safe.

- Convenience: Wallets allow you to quickly send and receive crypto, manage multiple assets, and track your portfolio from one location.

- Decentralization: Since you control the private keys, you retain full ownership of your assets, which aligns with the decentralization philosophy of cryptocurrencies.

- Access to DApps and DeFi: Many wallets, especially hot wallets like MetaMask, allow you to interact with decentralized applications (DApps) and decentralized finance (DeFi) platforms directly from the wallet.

Choosing the Right Crypto Wallet

Choosing the right wallet depends on your needs:

- Security: If you’re holding a significant amount of cryptocurrency or storing it long-term, consider a cold wallet like a hardware wallet.

- Convenience: For frequent trading or transactions, a hot wallet like a mobile or web wallet may be more convenient.

- Accessibility: If you want to interact with DApps and DeFi platforms, a non-custodial wallet like MetaMask is ideal.